We're raising money for the Isle of Wight Branch of the MND Association

What is ESG investing?

ESG investing refers to investing that prioritises environmental, social, and governance factors or outcomes. Also known as socially responsible investing, or impact investing, it’s widely seen as a way of investing sustainably, meaning investments are made with consideration of the environment and human wellbeing, as well as the economic outcome.

The principles of ESG investing aren’t new but the focus has shifted from exclusion to instead focus on the positive impact a company might have on the world, whether that’s environmental regarding climate change, social in terms of its human relationships, and governance, which covers areas such as leadership and board composition.

- Evolution of our ethical investing solutions

We first launched our ethical model portfolios in 2010. These were designed for investors who wished to ensure their money did not get invested in companies that derived the bulk of their earnings from alcohol and tobacco sales, gambling, pornography, armaments, and mining, or were involved in animal testing for cosmetic purposes. But their ethical and socially conscious investment choices meant that they generally had to accept a lower investment performance.

This lower performance was often attributed to the fact that during market events, there was little change in the habits of consumers who were addicted to gambling, smoking and drinking, while government defence budgets still needed to be spent and commodities such as gold boomed. The ethical exclusions removed many of the defensive investment opportunities that existed so ethical portfolios fell further during market downturns, meaning they had more ground to make up during the good times than their agnostic counterparts and this was rarely achieved.

- Sector growth

The ethical investment landscape provides a very different picture today. Principles-based investing is still led by an individual’s desire to ensure that their investments are not having a negative impact on humanity and the environment. However, better education and global government collaboration has shifted the focus away from exclusion-based investment and instead onto the positive impact companies are making. As a result there has been significant growth in the sector as organisations and individuals wake up to the links between environmental, social and economic acts. Investor demand has been met with increased action by businesses on ESG issues – and as a result, we are gradually seeing higher returns.

- Sustainable future

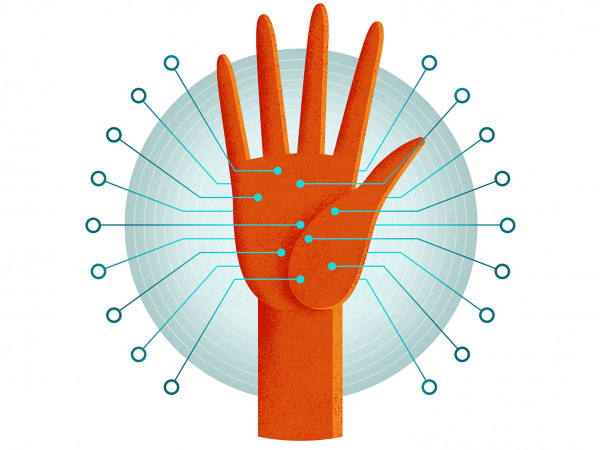

Screening that previously excluded unethical investments has been replaced with filters that look to attribute scores to companies based on their Environmental, Social and Governance (ESG) impact. Increasingly, investment managers are adopting the United Nation’s 17 Sustainable Development Goals (SDGs) to measure the positive ESG impact of the companies in which they invest. They provide a common framework to measure against and rather than excluding unethical investments the SDG filters look to attribute scores to companies to based on their ESG impact.

- The United Nations’ 17 Sustainable Development Goals

The United Nation’s 17 Sustainable Development Goals are intended to measure the positive ESG impact of the companies in which they invest.

Because ethical investing can mean different things to different people, the United Nation’s 17 SDGs provides the framework to assist the evolution but it has its limitations. For example, just screening for the best ESG companies won’t show the whole picture, which is why it’s important to talk to your financial planner about where you would like your money invested. The granular research within the SDGs is where the real change will happen.

The 17 SDGs are further broken down into 169 targets with 232 indicators. This provides a universally recognised set of actions which will address the global challenges of poverty, inequality, climate change, environmental degradation, peace and justice by 2030.

- Greenwashing

It’s estimated that around £14.5 trillion of ESG-orientated assets are being managed globally. This greater interest in ethical investing has increased the risk of greenwashing. Research has shown that investors aren’t confident that sustainability-related claims made about investments are genuine. A lack of consistency in terminology such as ‘green’ ‘ESG’ or ‘sustainable’ hasn’t helped either.

However, to tackle the issue, the Financial Conduct Authority (FCA) has created a substantial package of measures to improve the trust and transparency of sustainable investment products and minimise greenwashing. This includes Sustainability Disclosure Requirements and an investment labels regime following detailed engagement with a range of stakeholders, including consumer groups.

This includes:

- An anti-greenwashing rule for all authorised firms to make sure sustainability-related claims are fair, clear and not misleading

- Product labels to help investors understand what their money is being used for, based on clear sustainability goals and criteria

- Naming and marketing requirements so products cannot be described as having positive impact on sustainability when they don’t.

Whether it’s your pension or other savings, such as stocks and shares ISAs, you can choose to filter out investments that don’t reflect your ethics.